Collateral Management System

1Token enables financial service providers to monitor real time credit line and cross-margin status across bilateral loan, portfolio margin financing, and potentially OTC spot trading or derivatives trading.

Request Demo

Omni-Asset and Venues

1Token keeps up-to-date integration to major crypto trading venues that covers complete instruments and transaction types.

Exchanges and OTC

Custody and Banks

OEMS

Market Data Aggregators

DeFi Chains

DeFi Protocols

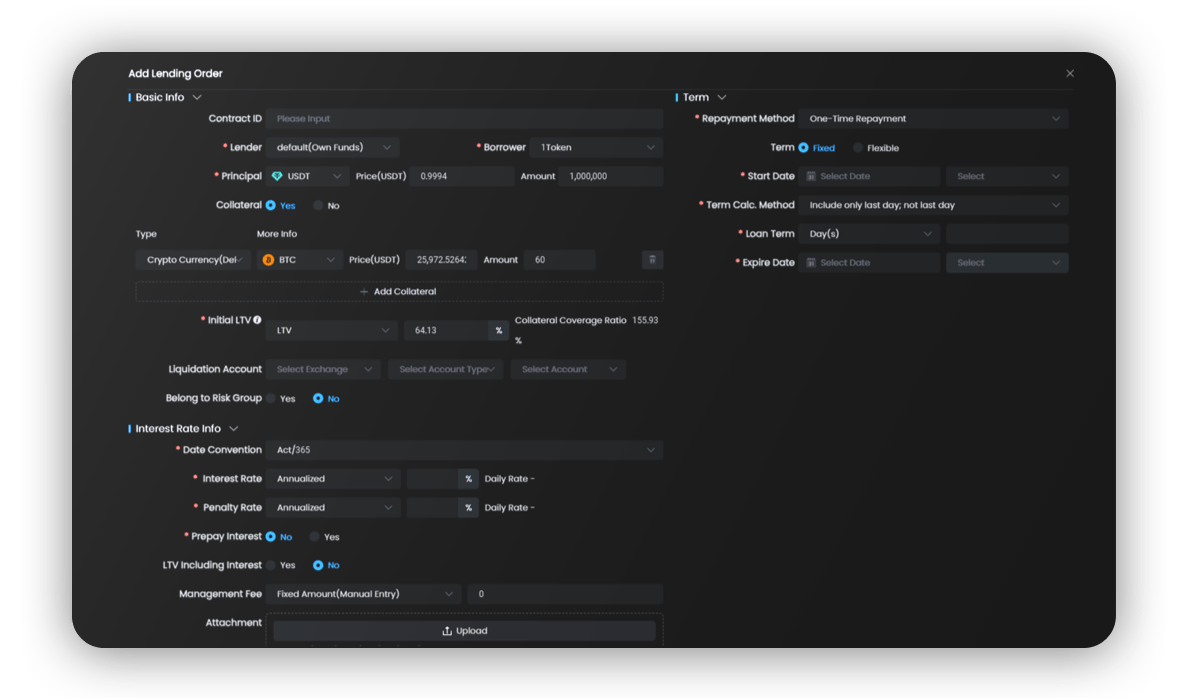

Bilateral Lending

For bilateral lending business, 1Token supports various collateral types besides most commonly used cryptocurrencies, and customized valuation strategies including index price and haircut.

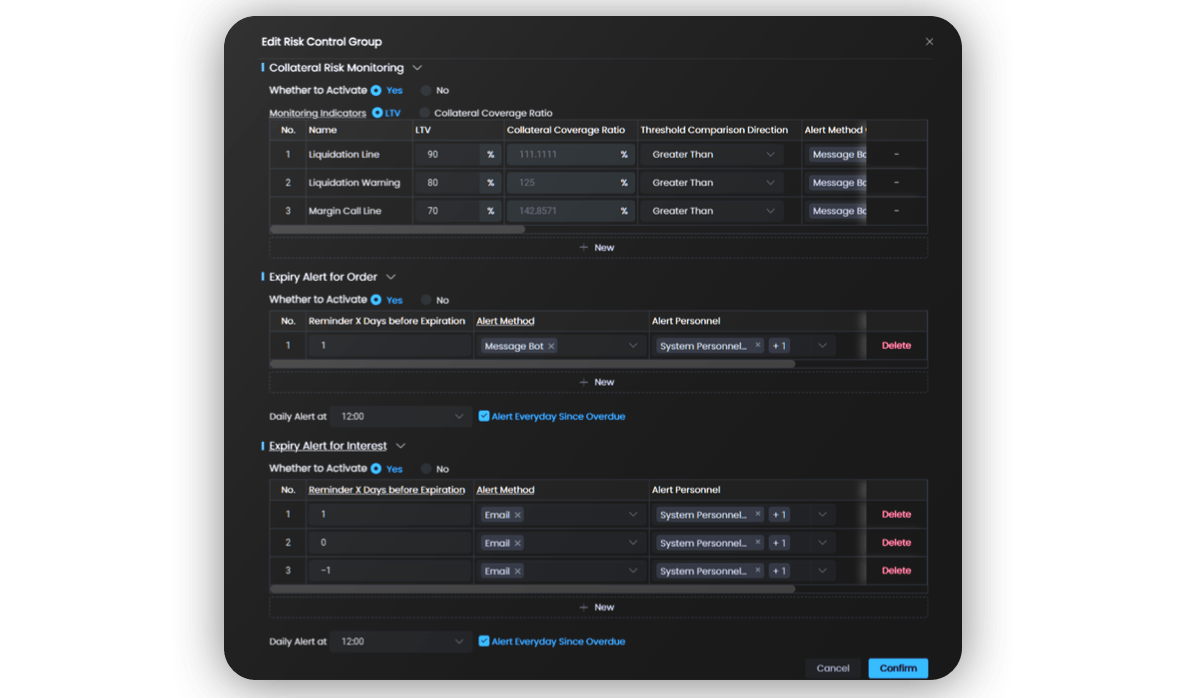

Once LTV threshold is reached, 1Token system instantly sends margin call to borrower via multiple channels and signal for forced liquidation available from 1Token API.

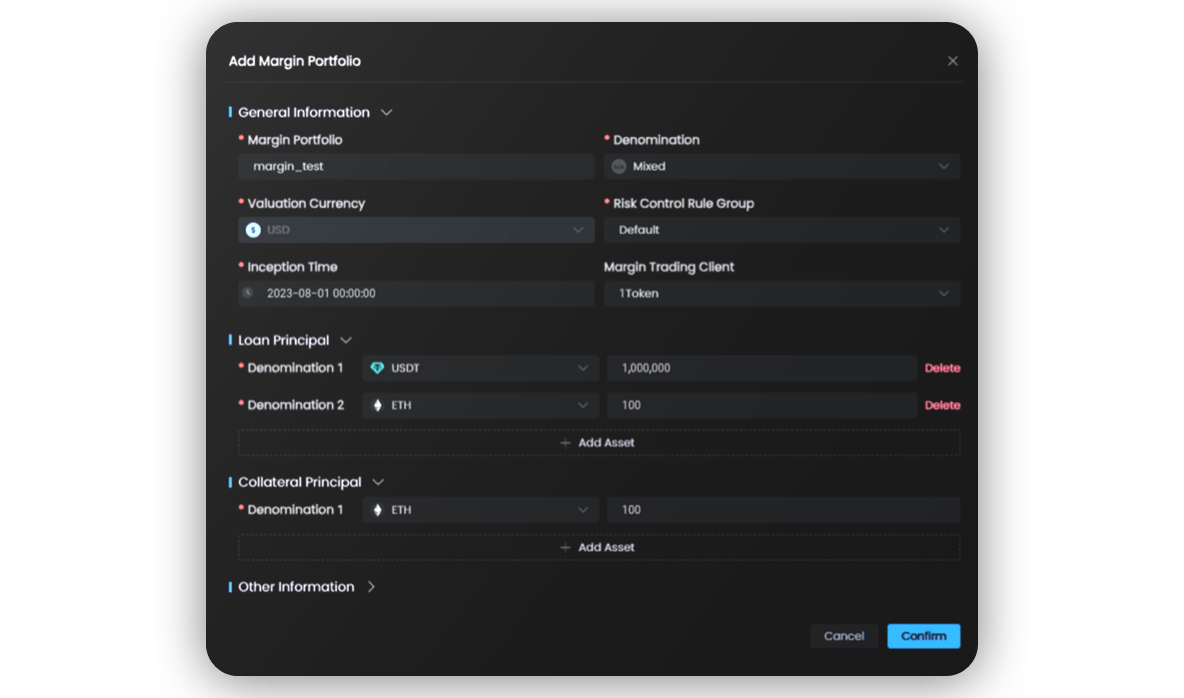

Portfolio Margin Financing

For portfolio margin financing business, 1Token monitors collateral coverage ratio with haircut rules for different coins and automatic interest accrual into collateral value calculation.

Once LTV threshold is reached, 1Token system instantly sends margin call to borrower via multiple channels and signal for forced liquidation available from 1Token API.

Cross Margin

Borrowers might be borrowing at multiple batches in both bilateral lending and portfolio margin financing, and even other financial services like OTC trades with post-trade settlement.

1Token enables financial service providers to set credit limit and calculate risk level to each counterparty with cross margin calculation across multiple orders in different services lines.

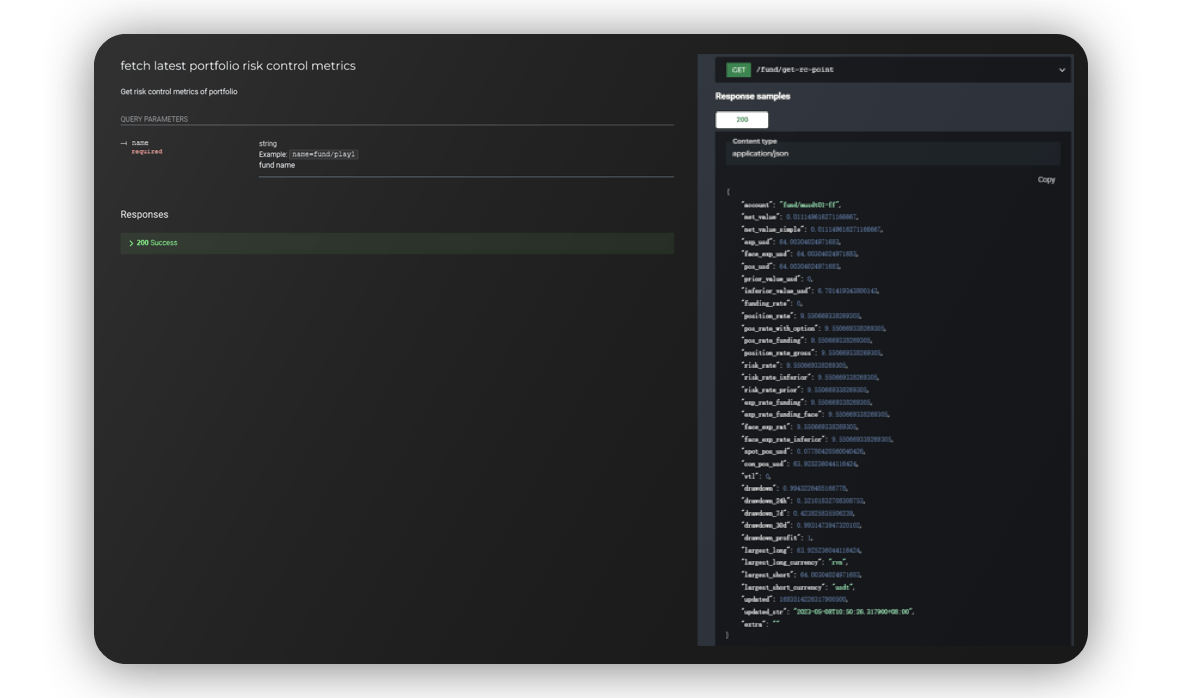

Signal for Liquidation

To handle drastic market conditions, 1Token can integrate with client’s designated venue or OEMS, to send liquidation order.

1Token also offers API for client’s own liquidation engine to sync LTV level to decide on liquidation.

Streamline Your Operations

Other Products

Loan Management System

Manage loan life cycle from booking to settlement, with flexible changes through loan lifetime.

Request Demo

Portfolio Management System

Real-time portfolio view across CeFi and DeFi, shadow NAV accounting and advanced analysis.

Request Demo

Risk Management System

Real-time and periodical trading metrics monitor, instant alerts in different levels to relevant users.

Request Demo