Risk Management System

1Token risk management system monitors real-time trading metrics, and alerts by importance via multiple channels. The system is battle tested to be robust from extreme market conditions in March 2020 and May 2021.

Request Demo

Omni-Asset and Venues

1Token keeps up-to-date integration to major crypto trading venues that covers complete instruments and transaction types.

Exchanges and OTC

Custody and Banks

OEMS

Market Data Aggregators

DeFi Chains

DeFi Protocols

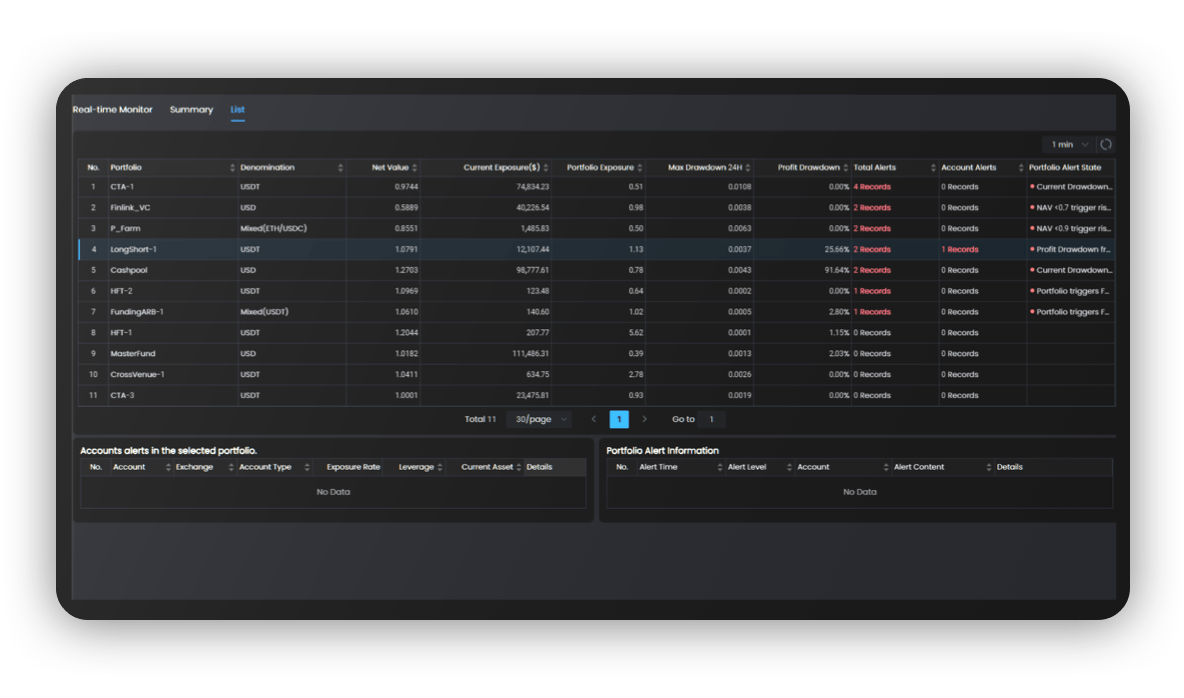

Real-time Risk Monitor

1Token monitors real-time risk metrics, including trading risk, market risk and counterparty risk, based on real-time API updates.

Trading risks including NAV, drawdown, exposure, leverage, MMR, trading limit.

Live Alerts

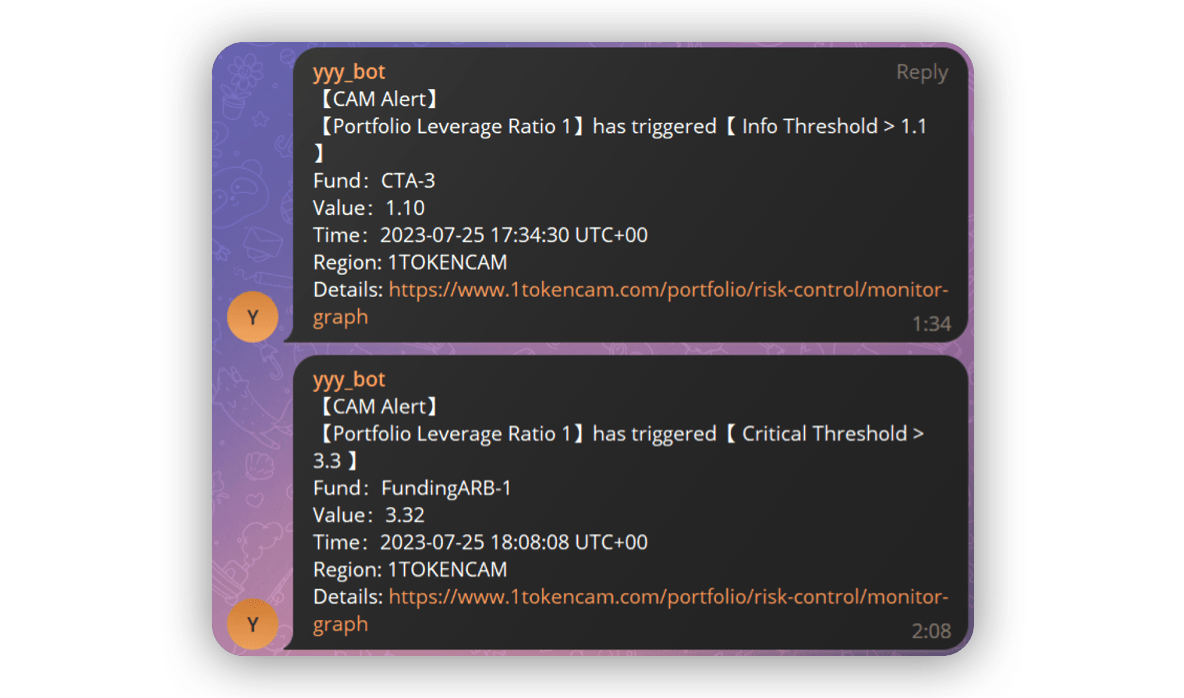

For different types of strategies, 1Token system can activate corresponding rules and thresholds.

Once the rules get violated, 1Token system sends alert to defined receivers based on threshold, via various channels to mobile phone or Telegram and Slack.

Prime brokers and lenders can send automatic margin call as official notification.

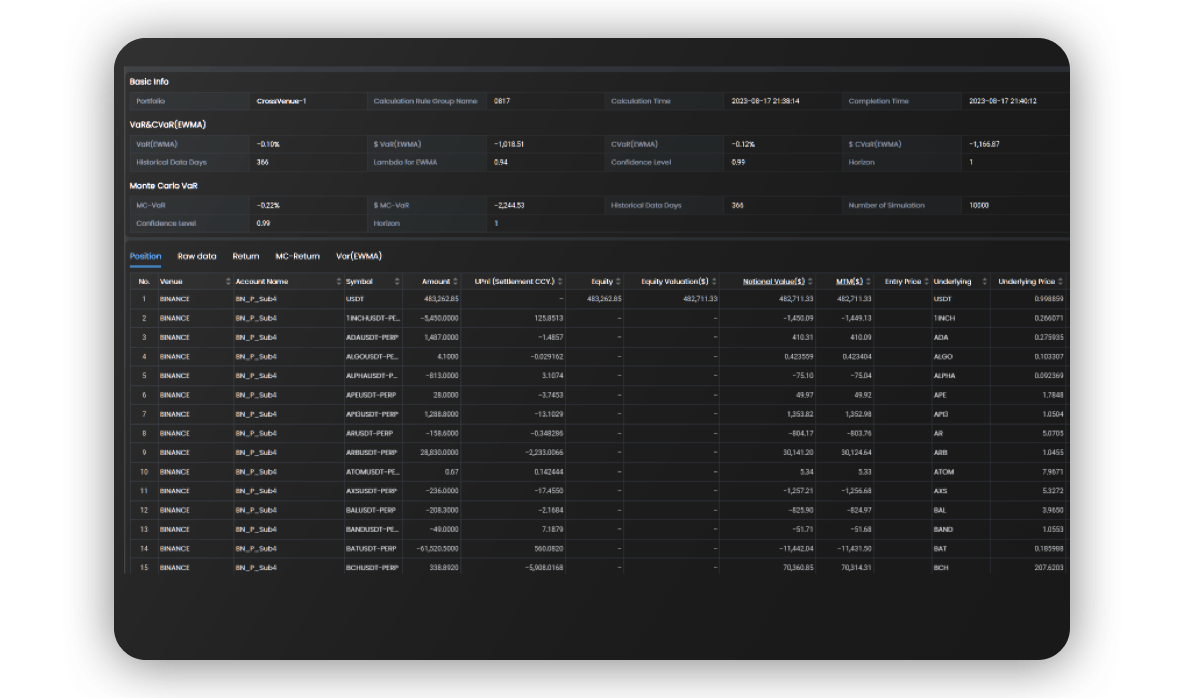

Post-trade Risk Report

To review historical performance on risk control, 1Token summarizes the live risk control history, and calculates advanced post-trade analysis including VaR, and stress testing to generate risk report.

Reports can be generated ad-hoc, or automatically at planned time, and provided by downloading from web or email to relevant users.

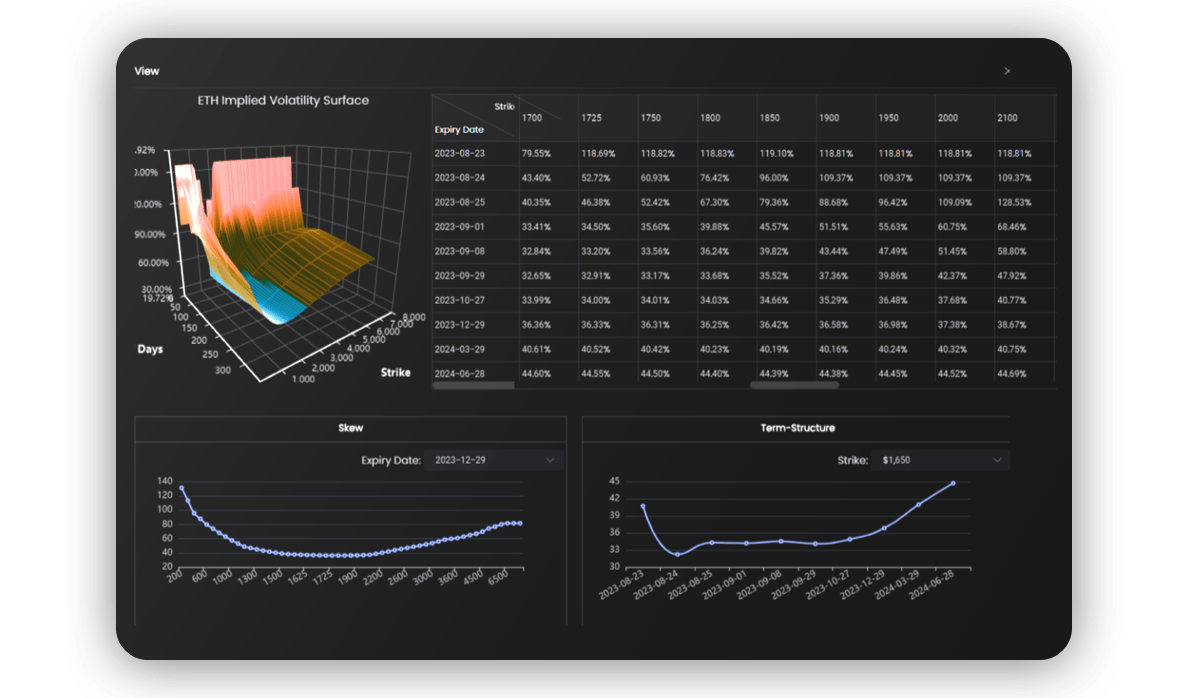

Derivatives Analytics

Whether you are trading derivatives in crypto exchanges (e.g., Deribit), traditional exchanges (e.g., CME), or OTC (e.g., Paradigm), 1Token aims to provide highest level of automation by API connection.

1Token supports options pricing with client’s own definition of volatility surface and yield curve, and Greeks analysis and simulations in different price and volatility scenarios.

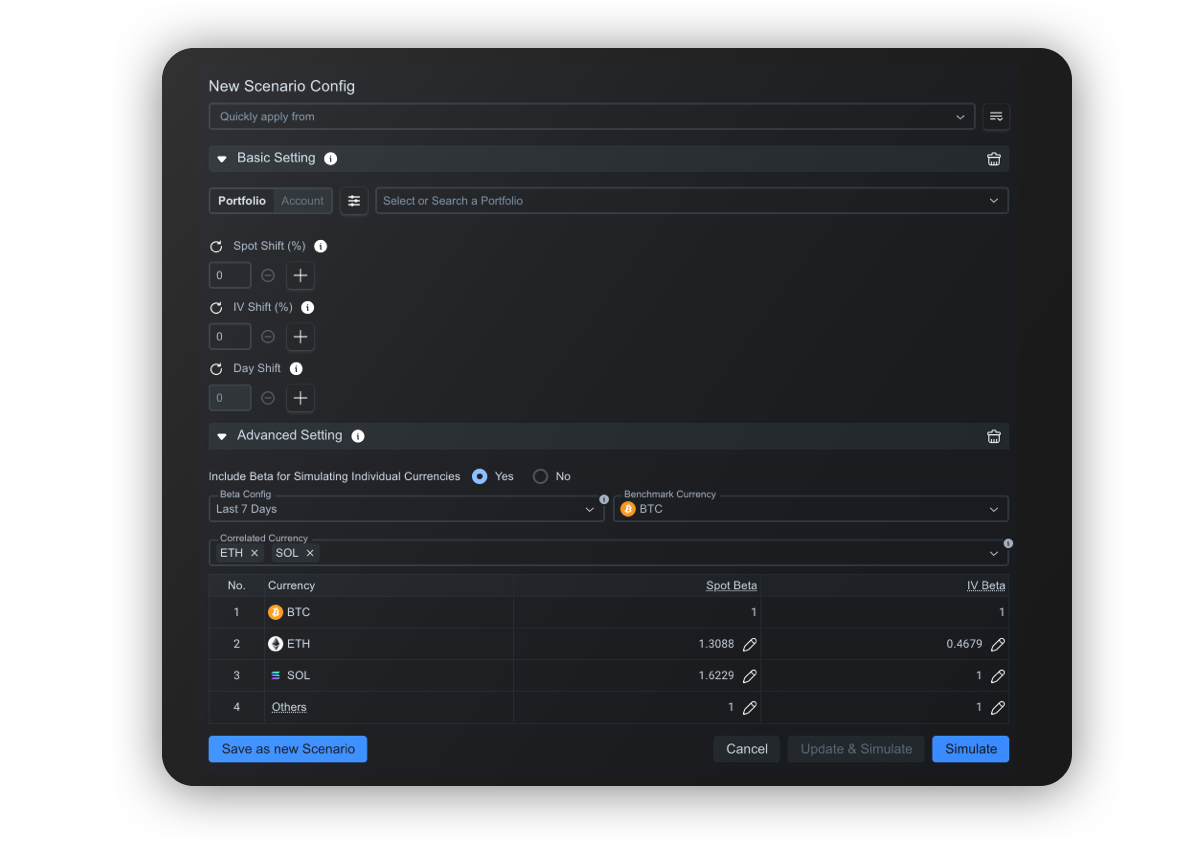

Stress Testing

Based on a portfolio, simulate change of

Underlying spot price

Underlying volatility

Date movement

Output simulated holdings, net asset and PnL

Streamline Your Operations

Other Products

Portfolio Management System

Real-time portfolio view across CeFi and DeFi, shadow NAV accounting and advanced analysis.

Request Demo

Data Collection & trade Reconciliation

Robust integration to trading venues covering all instruments and transaction types verified by trade reconciliation.

Request Demo

Collateral Management System

Real time cross-margin collateral status across bilateral loan, portfolio margin financing and margin trading.

Request Demo