Crypto fund platforms

Aiming to host 100 crypto funds?

For hedge fund platforms, to launch middle-back office (accounting, operations, and compliance) outsourcing service to crypto funds, or include PMS into the service package to crypto funds.

Request Demo

Tailored to Crypto fund platforms needs

1Token is the Institutional grade tool for fund platform’s digital asset practice.

Complete Venue and Asset Coverage

1Token keeps up-to-date integration to major crypto trading venues that covers complete instruments and transaction types.

Venue integration includes CeFi exchanges, OTC brokers, custody and OEMS, and DeFi EVM and non-EVM chains and protocols. (see integration list)

Asset coverage includes spot, perps, futures, options and earn products on CeFi, and DeFi yield farming activities like staking, AMM, borrow, lending and derivatives.

Scalability

To support hundreds or even over 1,000 CeFi accounts and DeFi addresses that generates millions transactions per day, 1Token implemented IP routing mechanism and storage optimization, that enables clients to see real-time updates, store complete and accurate history for high frequency trading without any missing trades or violation of exchange limits.

Security and Compliance

1Token insists institutional grade security and compliance.

1Token runs penetration test with 3rd party regularly to ensure institutional security level, and under audit for SOC2 compliance.

1Token provides both SaaS and on-premise deployment.

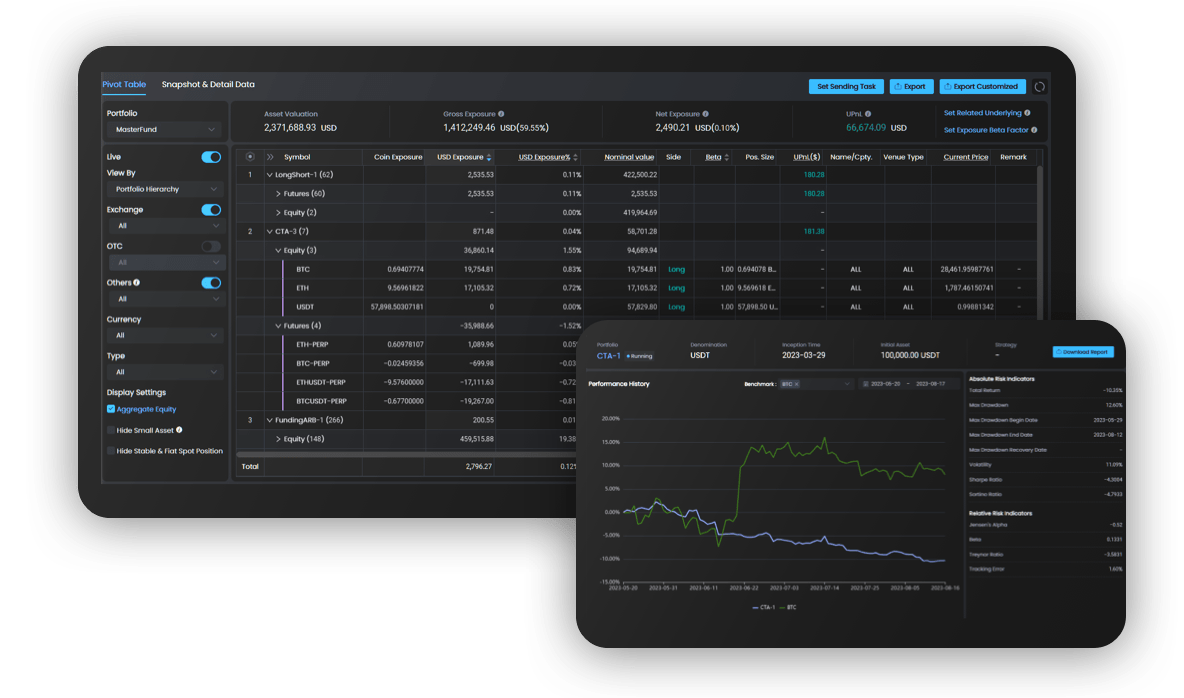

Robust Data Engine

Normalized real-time asset, position transaction history across CeFi and DeFi venues.

Robust and efficient system to support over 1,000 exchange accounts and millions of trades per day.

Battle-tested robustness during several times of drastic market conditions.

Battle-tested robustness during several times of drastic market conditions.

Risk control system for the asset manager.

Exchanges and OTC

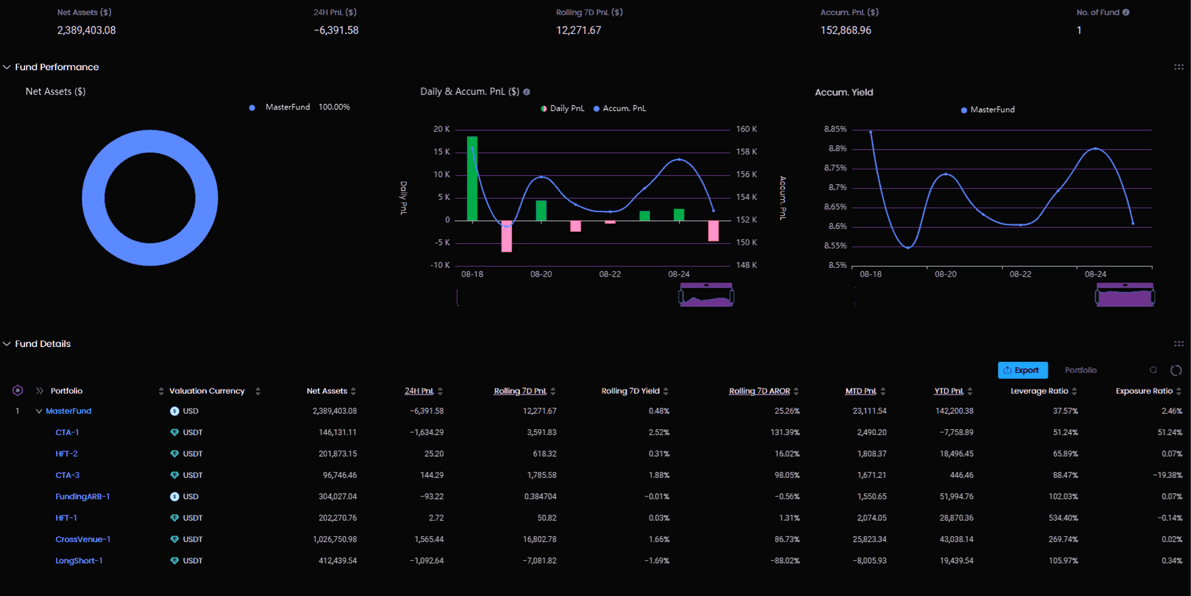

Portfolio Management

Grouping of accounts and address into portfolios, and further grouping of portfolio as main-sub structure.

Shadow NAV for reconciliation with fund admin, withe details of asset and position, position PnL, cost basis and PnL attribution with FIFO/LIFO/WAC method, in account and portfolio hierarchies.

Reconciled transaction history and reconciliation report for auditing purpose.

Exchanges and OTC

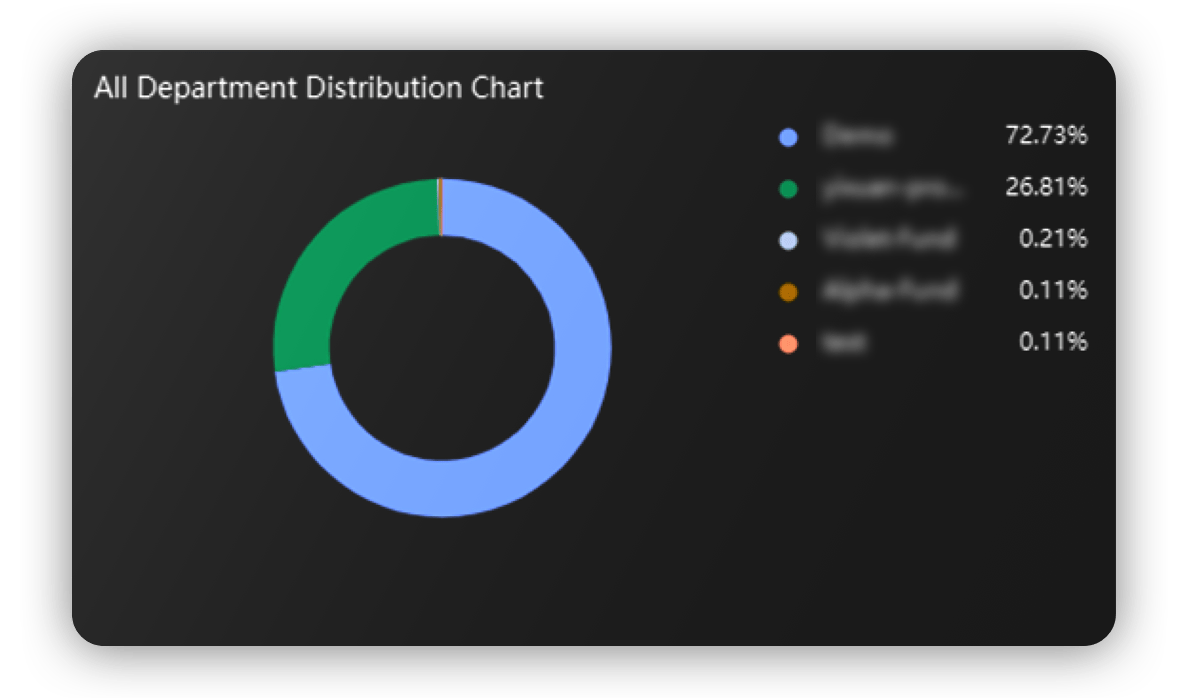

Multiple Departments

Multiple department structure to reflect SPC-funds structure, where each department is one SPC that hosts several funds.

Portfolio analysis and performance view of the whole SPC and each single fund.

Multiple users with role-based access and operation permissions that specifies to each department for fund managers to login and check their own data.

Exchanges and OTC

Transform Your Crypto Fund Service