Crypto Fund Professional Service

Aiming to serve 100 crypto funds?

For crypto fund admins and auditors to operate crypto fund business with max efficiency and scalability.

Request Demo

Crypto Trading Data Engine and Warehouse Addressing Fund Admins’ and Auditors’ Needs

For crypto fund admins and auditors serving complex funds, 1Token's institutional-grade crypto portfolio accounting solution offers:

Complete Venue and Asset Coverage

1Token keeps up-to-date integration to major crypto trading venues that covers complete instruments and transaction types.

Comprehensive venue integration includes CeFi exchanges, OTC brokers, custody and OEMS, and DeFi EVM and non-EVM chains and protocols. (Please see integration list)

Crypto Asset coverage includes spot, perps, futures, options and earn products on CeFi, and DeFi yield farming activities like staking, AMM, borrow, lending and derivatives.

Scalability

Handling huge amount of transactions in Cefi and Defi venues has been a challenge for crypto fund administrations and crypto fund auditors.

To support hundreds or even over 1,000 CeFi accounts and DeFi addresses that generates millions transactions per day, 1Token's crypto portfolio management and accounting system implemented IP routing mechanism and storage optimization, that enables clients to see real-time updates, store complete and accurate history for crypto high frequency trading without any missing trades or violation of exchange limits.

Security and Compliance

1Token crypto portfolio accounting software insists institutional grade security and compliance.

1Token runs penetration test with 3rd party regularly to ensure institutional security level, and under audit for SOC2 compliance

1Token provides both SaaS and on-premise deployment.

Robust Data Engine Handling Comprehensive Crypto Fund

Normalized real-time asset, position transaction history across CeFi and DeFi venues.

Battle-tested robustness during several times of drastic market conditions.

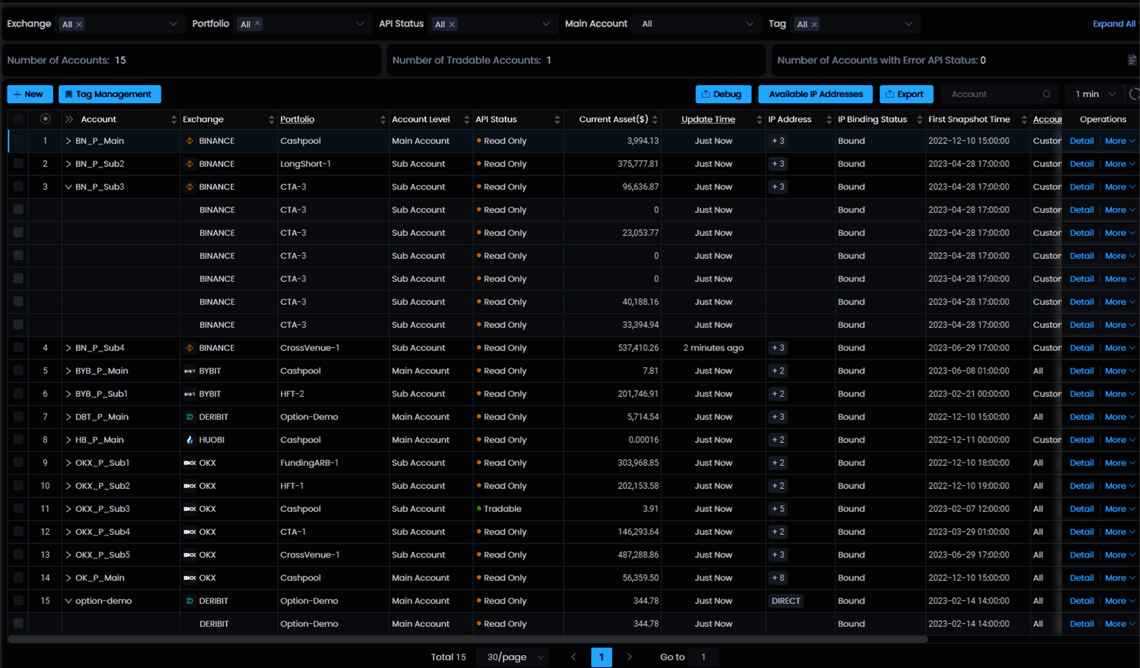

Robust and efficient system to support over 1,000 exchange accounts and millions of trades per day.

Reconciled crypto transaction history and crypto fund reconciliation report generation.

Exchanges and OTC

Crypto Portfolio Data Management

Built for crypto funds with comprehensive structure: Grouping of accounts and address into portfolios, and further grouping of portfolio as main-sub structure.

Real-time asset and position in account and portfolio hierarchies, presented as pivot table and graphs.

Analysis for crypto portfolios: Advanced analysis of position PnL, cost basis and PnL attribution with FIFO/LIFO/WAC method, in both portfolio level and account level.

Battle-tested robustness during several times of drastic digital asset market conditions.

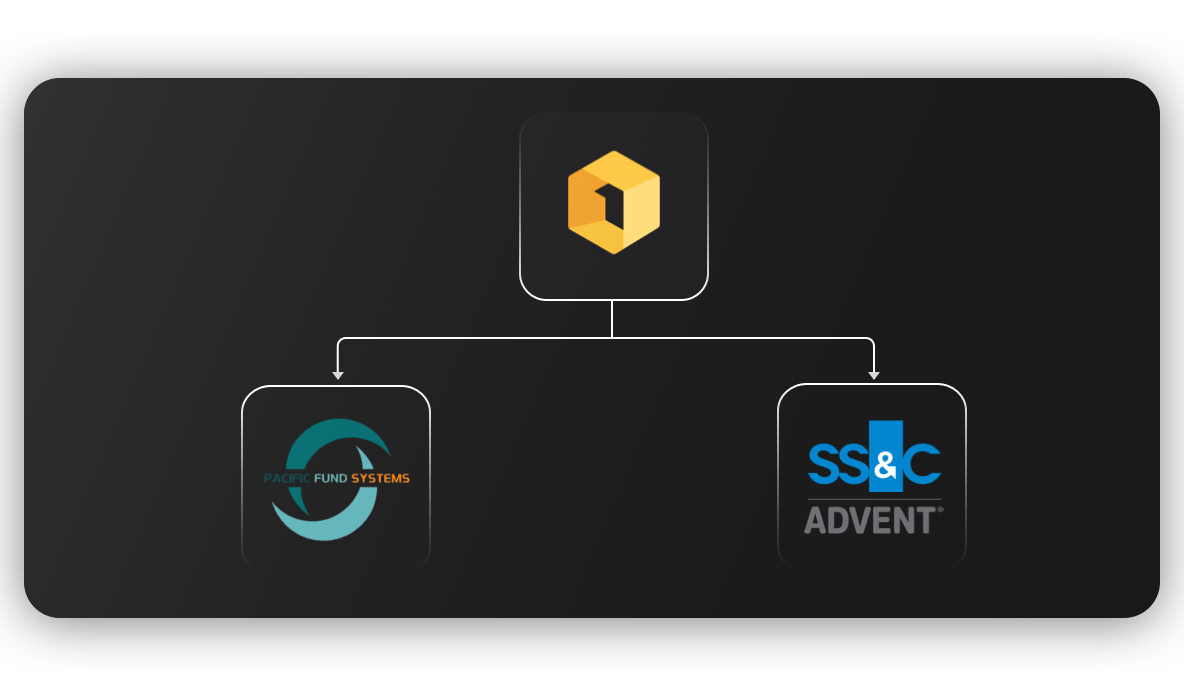

3rd party Integration for Crypto Fund Admin/Auditor Operations

Standard upload template and hands-on training to rebuild history from various sources of data.

Built for fund admins and auditors expanding into crypto markets: Sub-ledger load file export and import into 3rd party systems like Geneva and Paxus.

Onboarding support and training for traditional finance fund admins and auditors venturing into the digital asset industry: Specializing in crypto data importing and historical data rebuilding.

API for 3rd party programs to interact with 1Token system.

Insights on Portfolio Accounting for Digital Assets

Transform Your Crypto Fund Service