Prime Brokers

Adopt the infrastructure like top players

For prime brokers that provides direct market access (DMA) sponsored access and margin financing into managed trading accounts.

Request Demo

Tailored to Prime Brokers needs

DMA prime brokers, crypto exchanges, FoF / MoM, first loss protection funding products, yield funds.

Chosen by the Best

Since 2021 1Token has been serving prime brokers and manager of managers, now 1Token has been the choice of most of the largest prime brokers and top exchanges on DMA prime brokerage business.

Check our insight on DMA prime brokerage business https://tokeninsight.com/en/research/miscellaneous/crypto-fund-101-direct-market-access-prime-brokerage.

Scalability

To support hundreds or even over 1,000 CeFi accounts and DeFi addresses that generates millions transactions per day, 1Token implemented IP routing mechanism and storage optimization, that enables clients to see real-time updates, store complete and accurate history for high frequency trading without any missing trades or violation of exchange limits.

Security and Compliance

1Token insists institutional grade security and compliance.

1Token runs penetration test with 3rd party regularly to ensure institutional security level, and under audit for SOC2 compliance.

Token provides both SaaS and on-premise deployment.

Robust Data Engine

Normalized real-time asset, position transaction history across CeFi and DeFi venues.

Trading volume calculation with high accuracy and low latency across major exchanges.

Robust and efficient system to support over 1,000 exchange accounts and millions of trades per day.

Open API for prime broker’s own client facing GUI and other 3rd party systems to integrate.

Exchanges and OTC

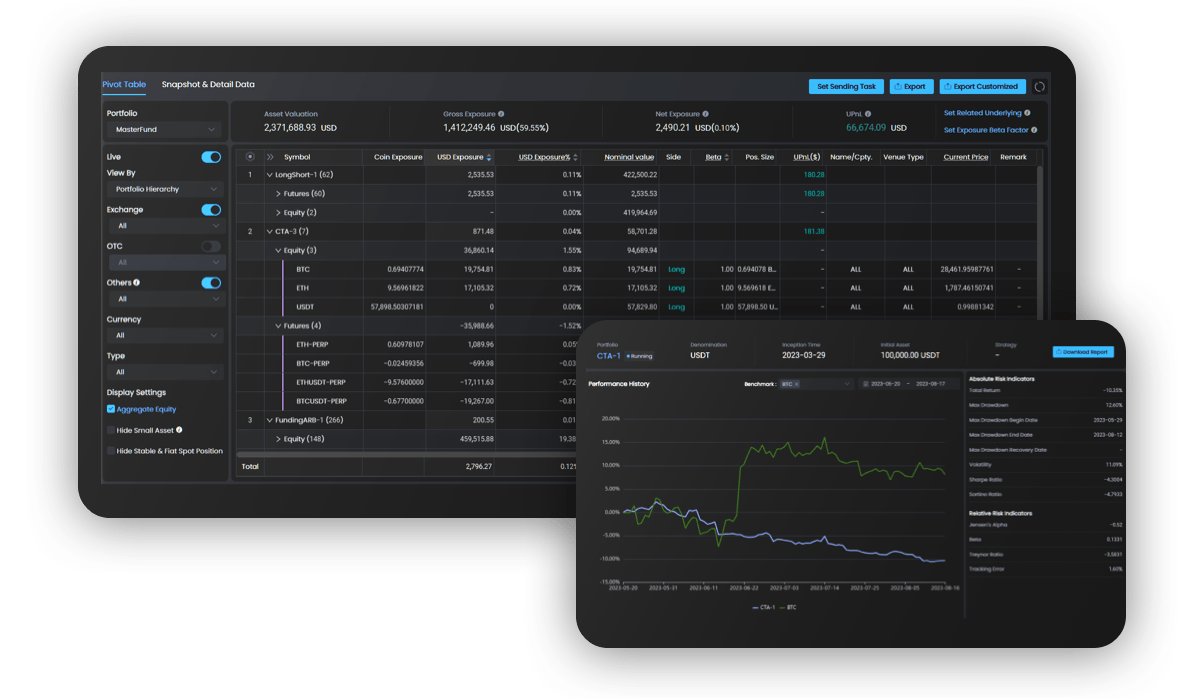

Portfolio Management

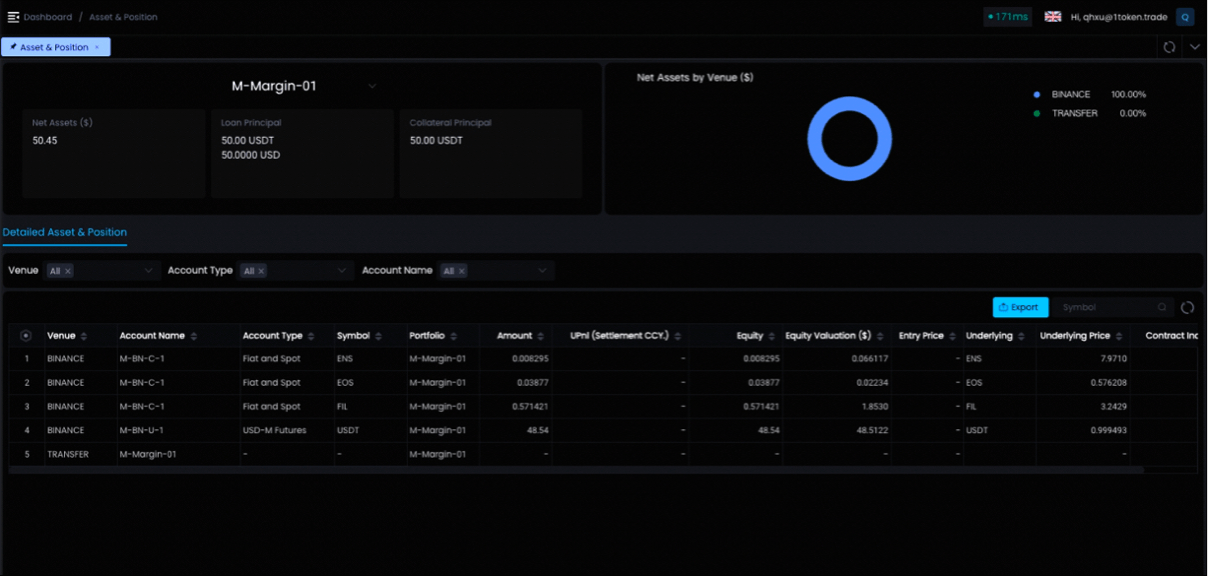

Real-time API updates to present asset and position in account, sub-portfolio and main portfolio hierarchies as pivot table and graphs, and calculate risk metrics like NAV, drawdown, exposure, leverage, MMR, trading limit, and exchange or protocol risk.

Battle-tested robustness during several times of drastic market conditions.

Post-trade analysis, from basic analysis like trading volume, funding fee, to advanced analysis of VaR, stress testing and PnL attribution.

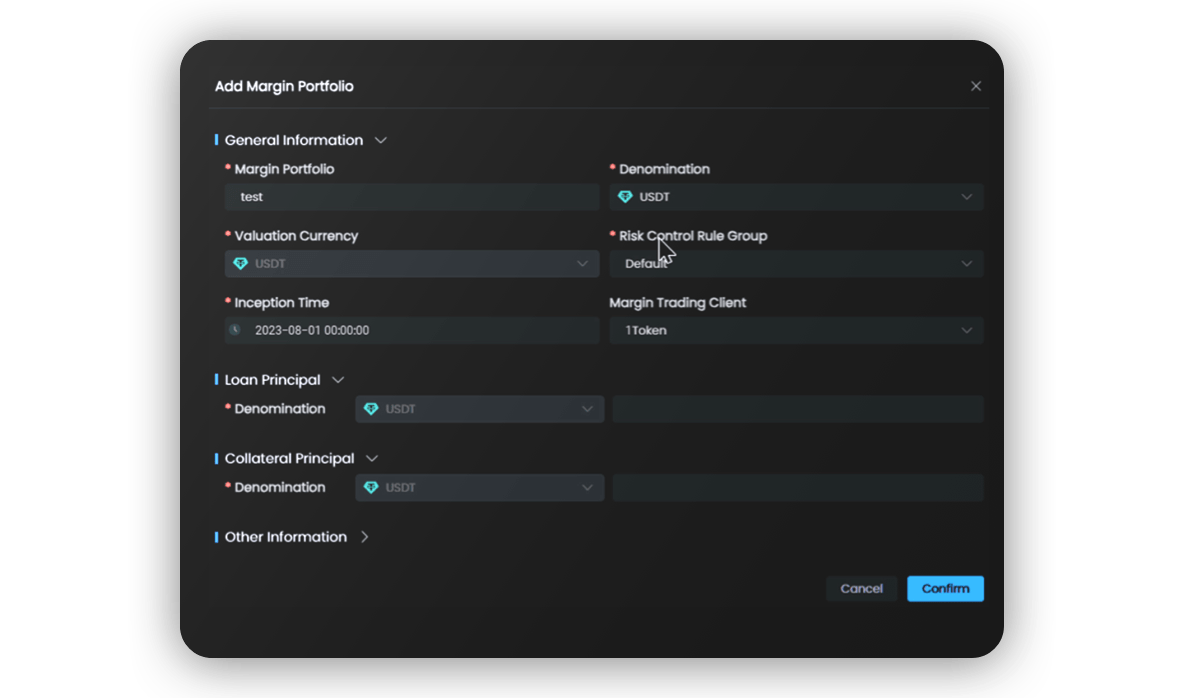

Collateral Management

Portfolio financing maintenance margin calculation with haircut rules for different coins.

Complex accounting support where loan and collateral can be denominated in different currencies.

Instant alert and margin call via various channels with customized rules and thresholds.

Automatic interest accrual into collateral value calculation.

Transform Your Prime Broker Operations