Treasury Managers

Real-time transparency across business units

For treasury managers who utilizes cash flow by allocating into various assets.

Request Demo

Tailored to Treasury Managers needs

VC funds, DAO treasury, large miners or general financial institutions/ UHNWI

Complete Venue and Asset Coverage

1Token keeps up-to-date integration to major crypto trading venues that covers complete instruments and transaction types.

Venue integration includes CeFi exchanges, OTC brokers, custody and OEMS, and DeFi EVM and non-EVM chains and protocols. (see integration list)

Asset coverage includes spot, perps, futures, options and earn products on CeFi, and DeFi yield farming activities like staking, AMM, borrow, lending and derivatives.

Multiple Users and Roles

1Token aims to meet all demands from front-desk traders, middle-back office function risk control and operations, and back-office function for finance and accounting.

Different users can be set as different access based on their role, and create customized views on their preference.

Security and Compliance

1Token insists institutional grade security and compliance.

1Token runs penetration test with 3rd party regularly to ensure institutional security level, and under audit for SOC2 compliance.

1Token provides both SaaS and on-premise deployment.

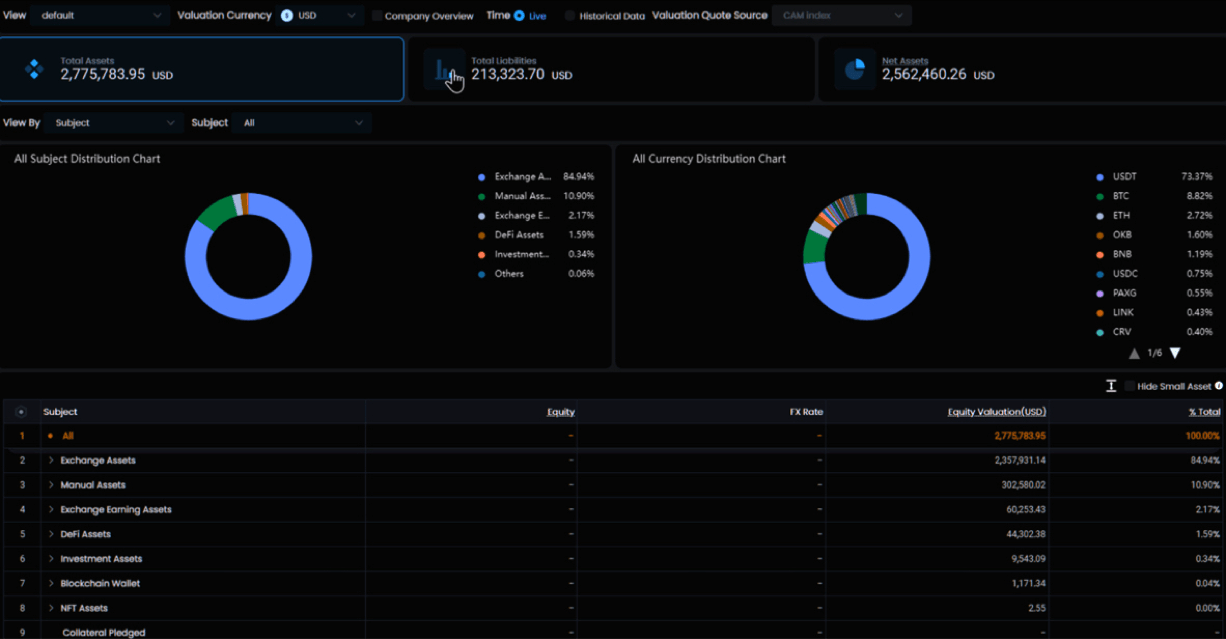

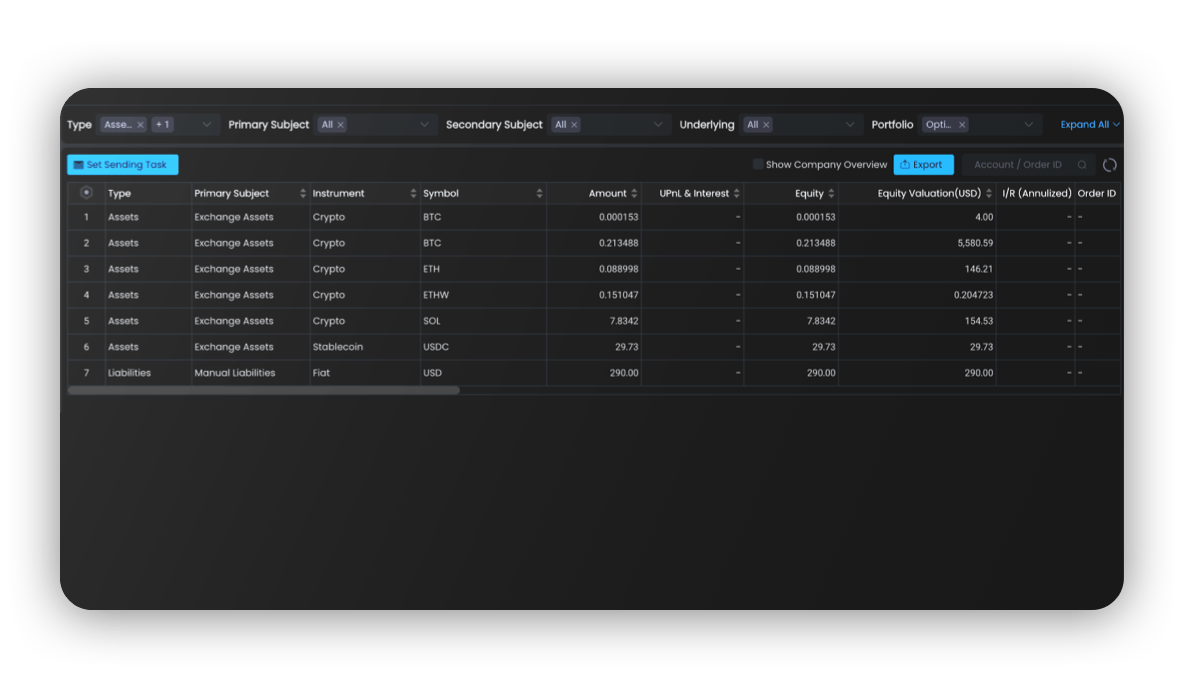

Balance Sheet

Balance sheet of asset and liabilities by type, venue and currency including cryptocurrencies and fiat.

Real-time view and historical snapshots in table and graph.

Customizable pricing source from exchange or data aggregators (CoinMarketCap).

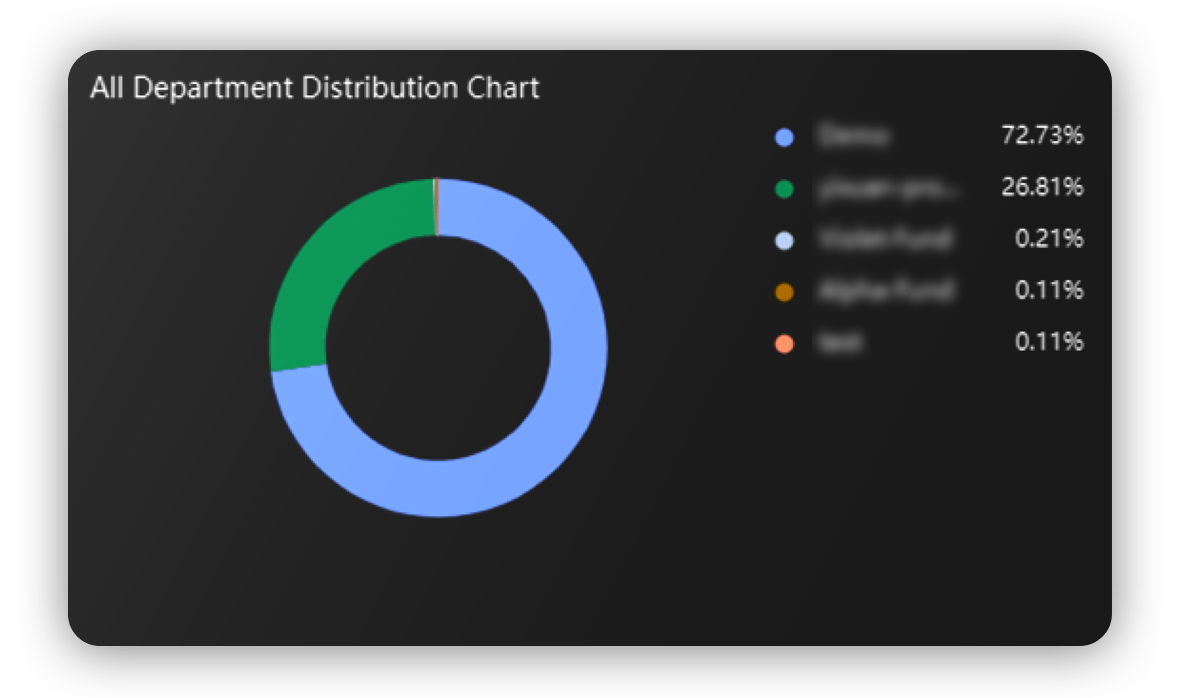

Multiple Departments

Multiple department structure to reflect multiple desks in the financial service provider company.

Multiple users with role-based access and operation permissions that specifies to each department.

Intra-company and inter-department trade booking and transfer pricing to reflect internal business relationship.

Balance sheet and performance view of the whole company and each single department.

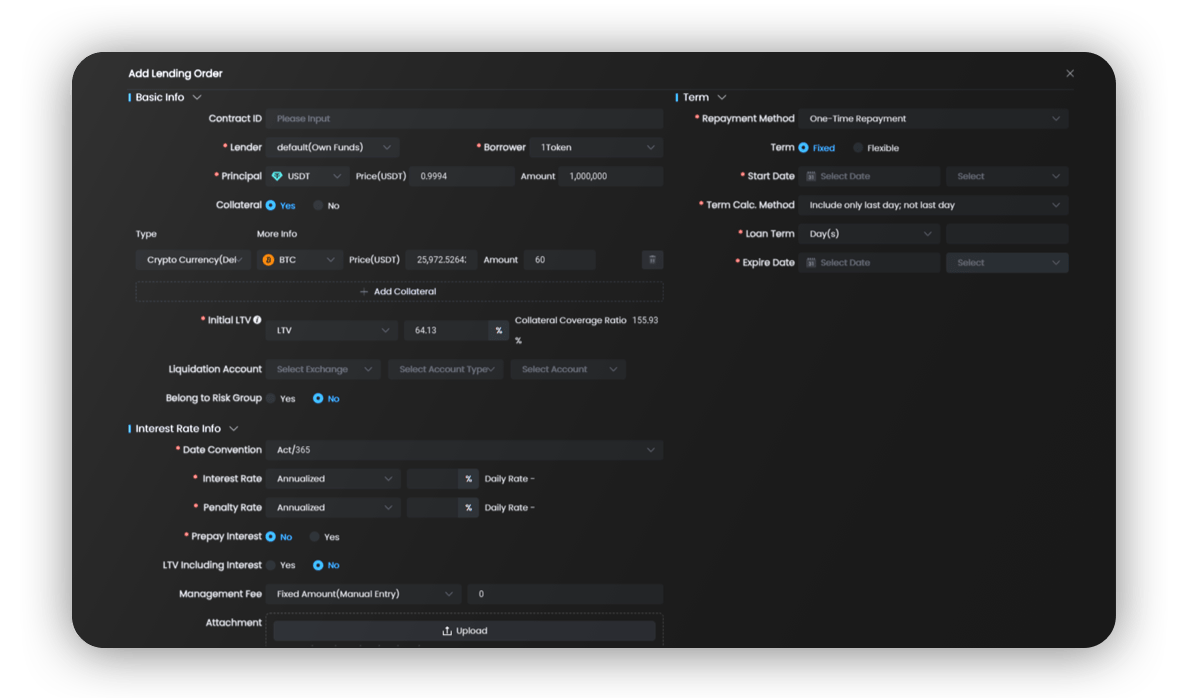

Loan Maintenance

Flexible loan order settings, including broker or deal mode, interest rules, fixed or open term, and various installments.

Flexible loan lifetime activities including repayment in advance, change interest rate etc.

Maker and checker scheme to ensure correct input on loan activities.

Full audit trial of loan lifetime activities.

Transform Your Treasury Management