Asset Managers

Aiming to serve 100 allocators?

For asset managers who raise USD or a combination of USD and cryptocurrencies, trade single managed accounts or segregated managed accounts.

Request Demo

Tailored to Asset Managers needs

Asset managers, wealth managers, investment advisors

Complete Venue and Asset Coverage

1Token keeps up-to-date integration to major crypto trading venues that covers complete instruments and transaction types.

Venue integration includes CeFi exchanges, OTC brokers, custody and OEMS, and DeFi EVM and non-EVM chains and protocols. (see integration list)

Asset coverage includes spot, perps, futures, options and earn products on CeFi, and DeFi yield farming activities like staking, AMM, borrow, lending and derivatives.

Multiple Users and Roles

1Token aims to meet all demands from front-desk traders, middle-back office function risk control and operations, and back-office function for finance and accounting.

Different users can be set as different access based on their role, and create customized views on their preference.

Security and Compliance

1Token insists institutional grade security and compliance.

1Token runs penetration test with 3rd party regularly to ensure institutional security level, and under audit for SOC2 compliance.

1Token provides both SaaS and on-premise deployment.

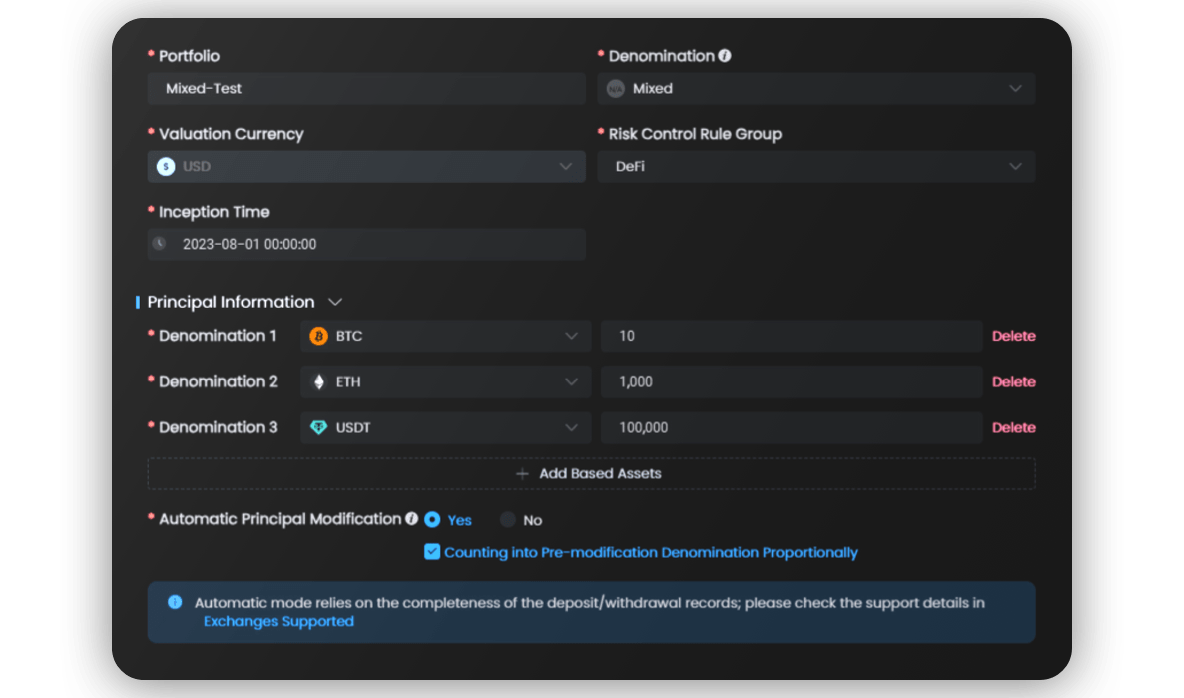

Mixed Denomination and Investor Reporting

Complex accounting support - asset managers can take a basket of different coins as principal (e.g., 100 BTC and 5 million USDT), and 1Token will calculate PnL and NAV based on the mixed denominated principal. In above case, NAV is 1.02 if equity becomes 102 BTC and 5.1 million USDT.

Periodical profit settlement handling to maintain smooth NAV trend.

Investor portal to see performance, with customization of content shared.

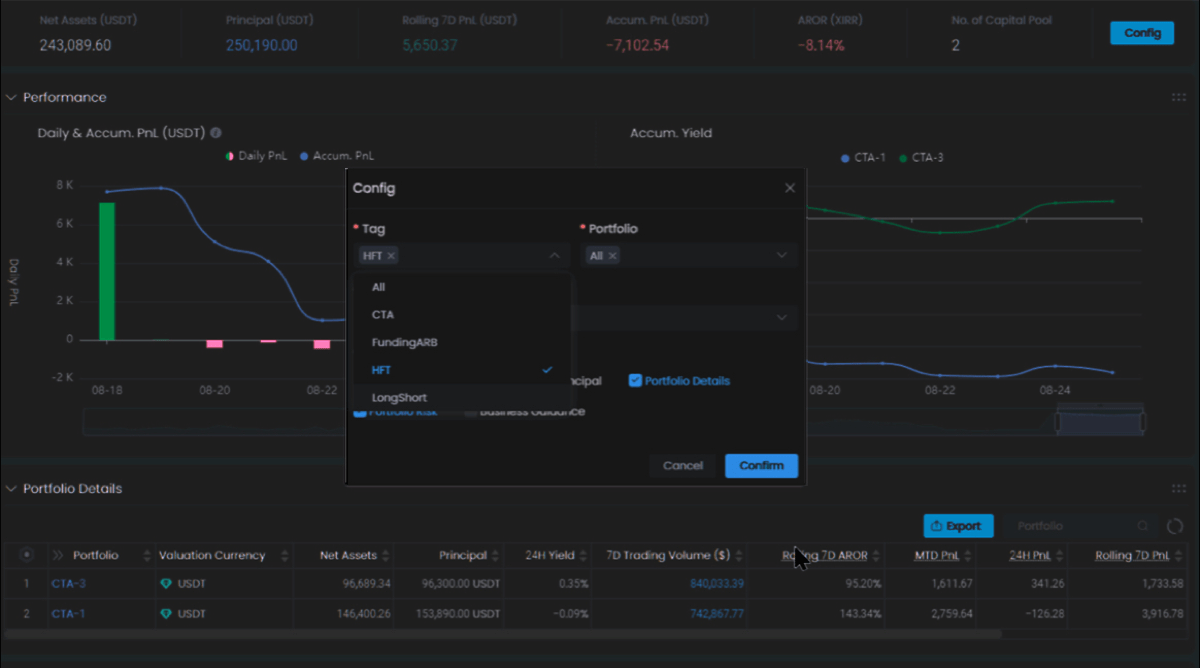

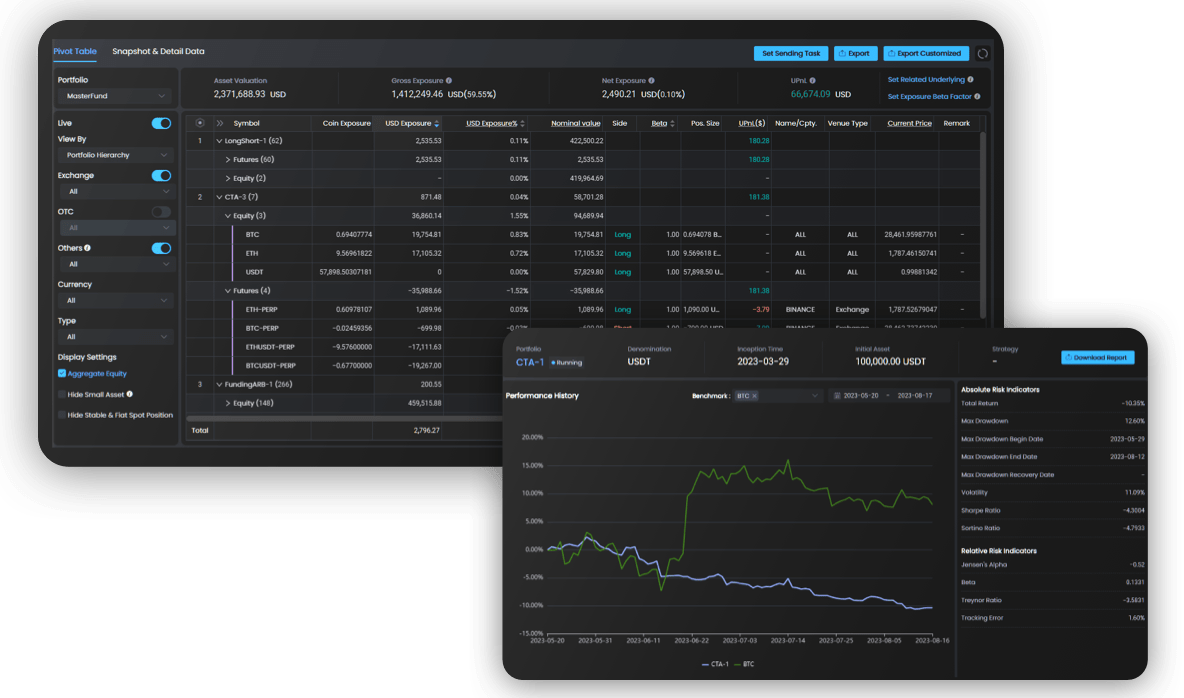

Portfolio Management

Grouping of accounts and address into portfolios, and further grouping of portfolio as main-sub structure.

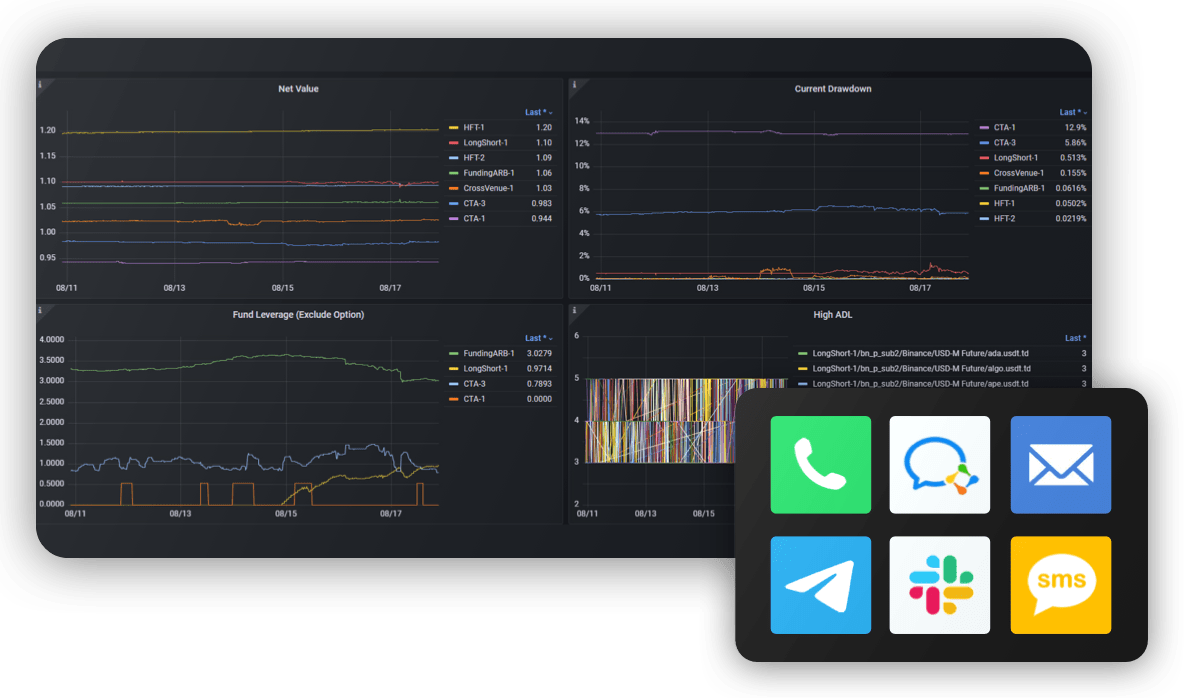

Real-time asset and position in account, sub-portfolio and main portfolio hierarchies, presented as pivot table and graphs.

Post-trade analysis, from basic analysis like trading volume, funding fee, to advanced analysis of PnL attribution.

Live and historical data can be used by 3rd party system by export or API.

Risk Management

Real-time API updates and calculates risk metrics like NAV, drawdown, exposure, leverage, MMR, trading limit, and exchange or protocol risk.

Derivatives Greeks analysis with customizable volatility surface setting.

Instant alert via various channels with customized rules and thresholds.

Post-trade risk reports including VaR, and stress testing, and can be set to generate and send to relevant users.

Transform Your Asset Management