Lenders

Operating system for lending institutions

For crypto lenders with secured loans and unsecured loans, open and fixed terms, and various interest calculation rules.

Request Demo

Tailored to Lenders needs

Asset managers, wealth managers, investment advisors

Tailor Made for Digital Asset Lenders

1Token is a crypto-native tech firm, that understands deeply how digital asset market and crypto financial service works.

The solution is tailor made to crypto market participants, with technical integration to all the counterparties, accounting rules that fits digital asset firms and.

Besides loans, full suite of crypto financial services can be managed in 1Token system, including OTC Spot / derivatives with crypto or FX, DMA prime brokerage, and yield products.

Multiple users and roles

1Token aims to meet all demands from front-desk traders, middle-back office function risk control and operations, and back-office function for finance and accounting.

Different users can be set as different access based on their role, and create customized views on their preference.

Security and Compliance

1Token insists institutional grade security and compliance.

1Token runs penetration test with 3rd party regularly to ensure institutional security level, and under audit for SOC2 compliance.

1Token provides both SaaS and on-premise deployment.

Loan Maintenance

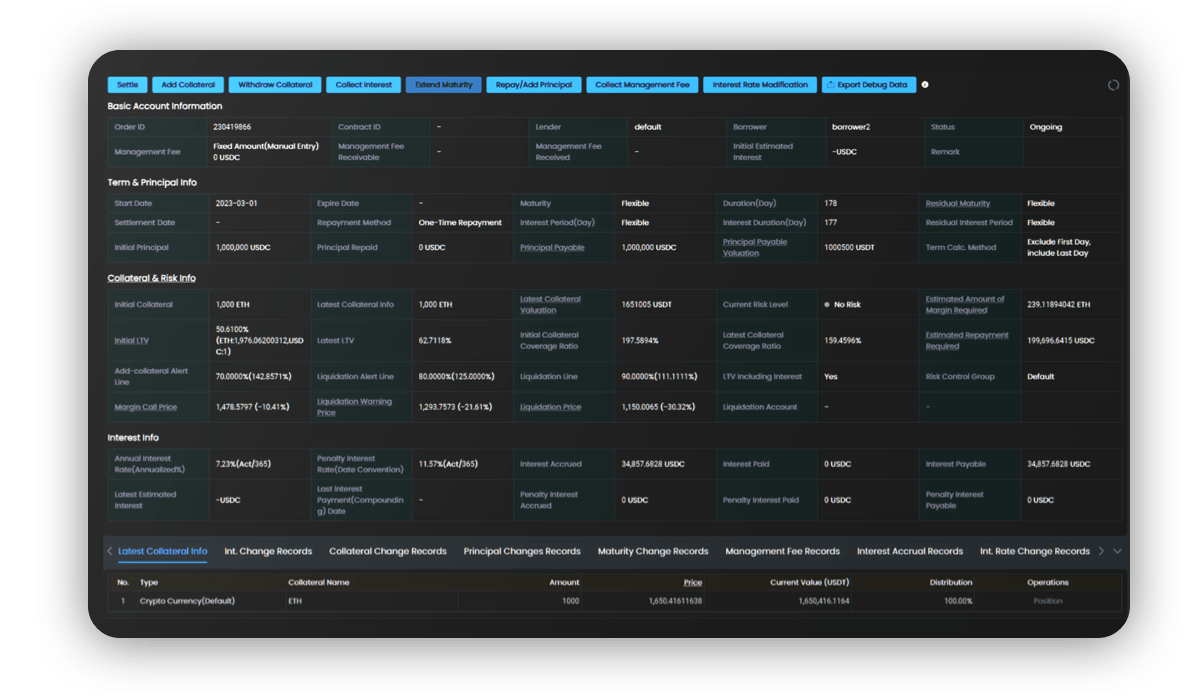

Flexible loan order settings, including broker or deal mode, interest rules, fixed or open term, and various installments.

Flexible loan lifetime activities including repayment in advance, change interest rate etc.

Maker and checker scheme to ensure correct input on loan activities.

Full audit trial of loan lifetime activities.

Collateral Management

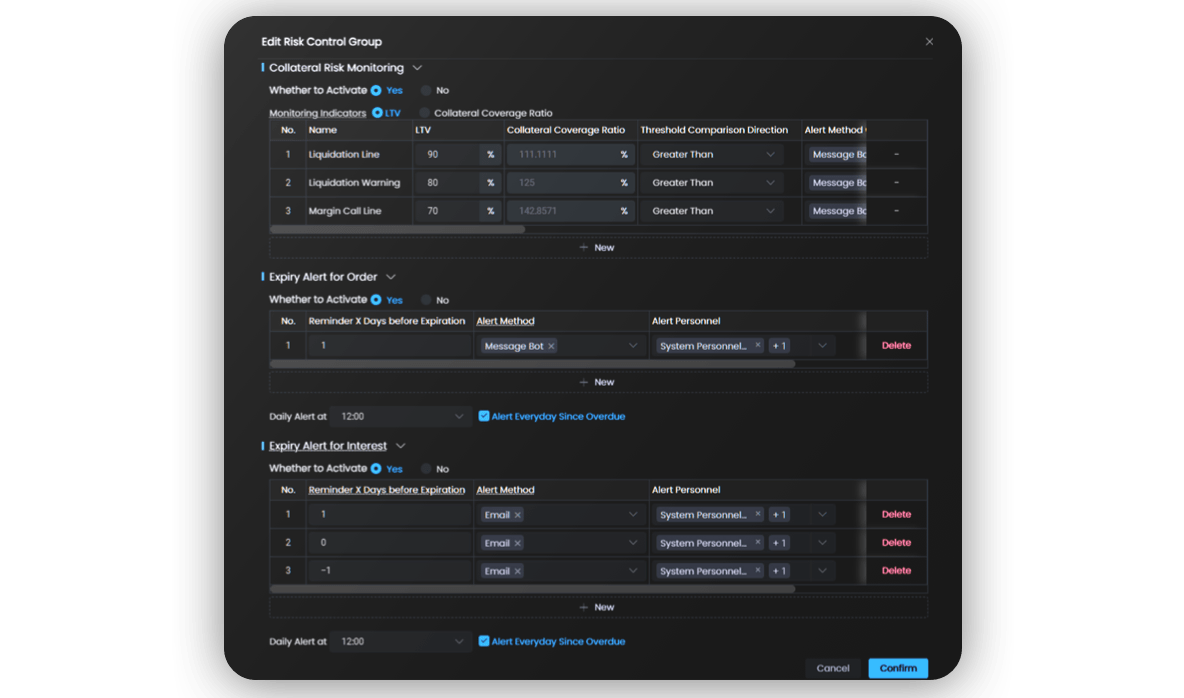

7*24 live collateral management with various collateral options including cryptocurrencies, exchange account and DeFi AMM LP Token with customized calculation strategies including index price and haircut.

Instant margin call to borrower via multiple channels and signal for forced liquidation available from 1Token API.

Post-trade analysis, from basic analysis like trading volume, funding fee, to advanced analysis of PnL attribution.

‘Loan account’ structure, to manage collateral across multiple orders to one same counterparty.

Back-office Automation

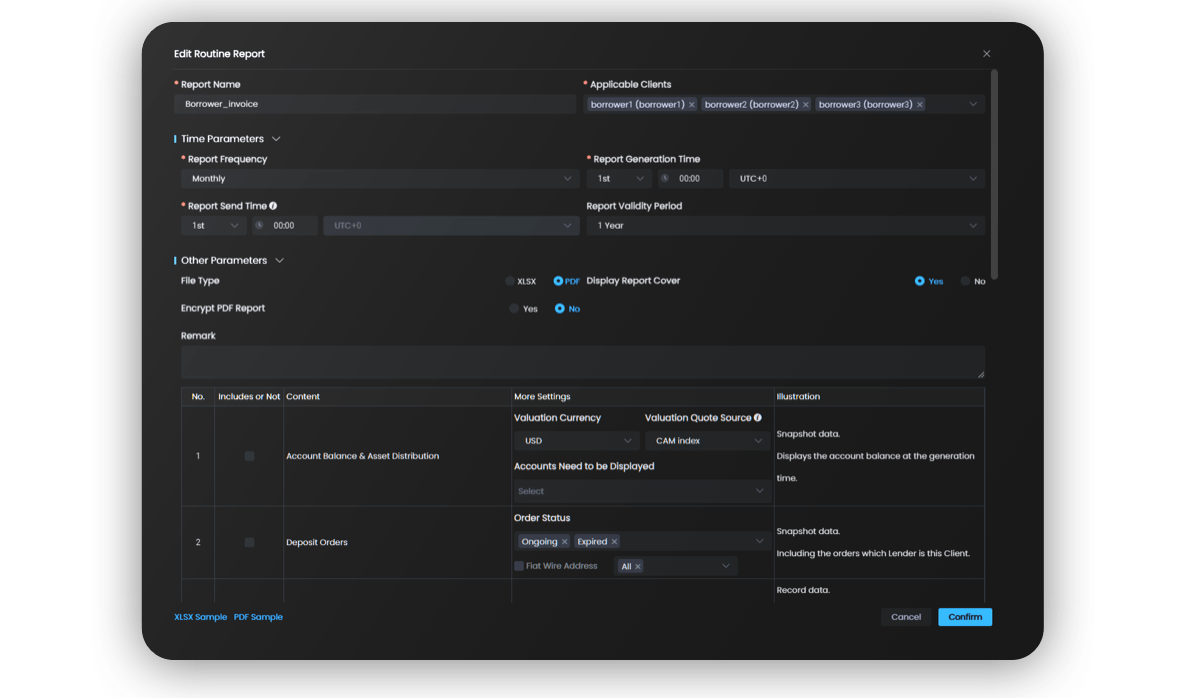

Automatic client statements with customizable template.

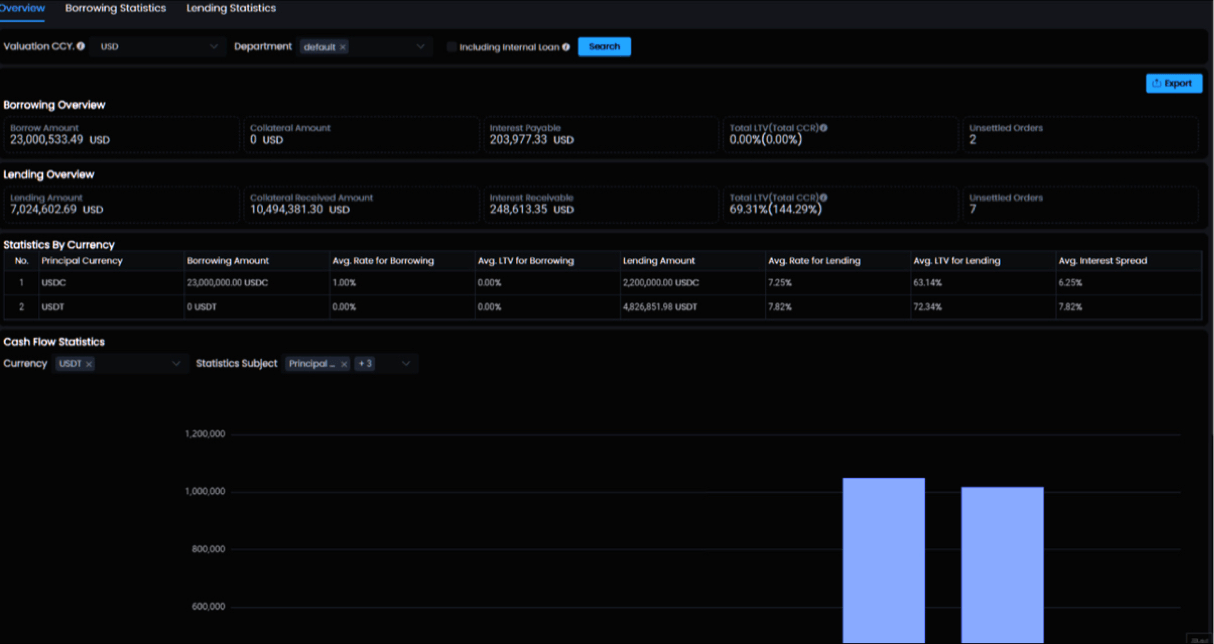

Loan business dashboard and various analysis for loan portfolio managers.

Loan income and cost statistics for financial accounting.

Data import and export for seamless integration with 3rd party systems.

Transform Your Crypto Loan Management